The 5 best expense management software solutions of February 2026

- Introduction

- What is expense management software?

- Key features to look for in expense management software

- The 5 best expense management software solutions of February 2026

- Six steps to follow in your expense management workflow

- Top 5 benefits of automated expense management

- The role of AI in expense automation

- Accelerate your expense management with Brex AI

- Navigating the complexities of global expense management

- Case study: DoorDash

- Let expense management automation do the work for you

Effortless expenses start here.

Introduction

Despite the digital revolution in business operations, a surprising trend has emerged in expense management. Since 2021, the adoption rate of expense management software has remained relatively stagnant. Recent surveys reveal that between 39% and 47% of companies use these tools to track and manage expenses, with a 2% increase in adoption over the past few years.

Why are businesses hesitant to embrace these potentially cost-saving solutions? Another survey says one-third of businesses still use some combination of manual processes, such as spreadsheets or paper receipt tracking. This approach may work for them in some capacity, but it’s likely a painstaking process for employees to record expenses, create reports, and submit them for approval.

Managers then have to manually approve expense reports, while accounting teams have to manually enter that data into an accounting system line by line, and process employee reimbursements. The entire procedure not only means employees are paid back slower, but finance teams are spending way more time on tedious tasks than strategic work.

The solution is to leverage modern expense management software, which automates and simplifies these processes. Platforms like Brex have shown that automating expenses and accounting can save teams up to 4,250 hours per year* through accounting automation. By using an integrated expense tool, employees and managers can handle everything in one place, from capturing a receipt with a phone camera to approving reports with one click.

This article will explain what expense management software does, highlight important features to consider, explore current trends, and review some of the best expense management software solutions available.

What is expense management software?

Expense management software is a digital allows you to track, manage, and control employee spending with automation, and helps you reduce the internal burden of managing employee expenses. It replaces manual expense reporting with an integrated software where employees can log expenses (often by simply snapping a photo of a receipt or using a mobile app), and those expenses flow through approval workflows into the company’s accounting records. In short, expense management software lets employees, managers, and finance teams all handle expense tasks in one place with far less hassle

With a good expense management solution, an employee can pay for a business lunch on a company card, have the receipt automatically captured and matched to the transaction, and submit an expense report with a click. Managers get notified to approve expenses digitally, and the system can automatically flag any out-of-policy spends (for example, a receipt that includes an unallowed expense like alcohol). Approved expenses then sync to the company’s accounting or ERP system, and any out-of-pocket purchases can be reimbursed through direct deposit. All of this happens within the software, eliminating the need for paper receipts, manual spreadsheets, or tedious data entry. The result is a faster, more accurate expense process that saves everyone time.

Key features to look for in expense management software

Selecting expense management software requires understanding which capabilities actually drive efficiency versus those that simply digitize manual processes. The platforms worth considering share several fundamental characteristics that transform spending oversight from reactive review to proactive control.

Automatic policy enforcement

The most significant advancement in expense management isn't faster reimbursements. It's preventing policy violations before they happen. Leading platforms now block or flag questionable transactions at the moment of purchase, rather than catching them weeks later during manual review.

This shift to preventive controls fundamentally changes how finance teams operate. Instead of reviewing hundreds of routine, compliant transactions, expense tracking software automatically approves in-policy expenses and only surfaces exceptions for human review. A marketing manager booking a flight within budget guidelines sees instant approval, while an attempt to book a first-class ticket triggers immediate review when policy requires economy travel.

Multi‑level approval workflows

Modern platforms route expenses based on amount thresholds and organizational hierarchies. A $500 client dinner might need only a manager's sign-off, while a $50,000 vendor payment requires CFO approval. These graduated approval levels ensure appropriate oversight without creating bottlenecks for routine purchases. Companies can configure different thresholds by expense category, recognizing that a $5,000 software subscription might be routine while a $5,000 entertainment expense warrants additional scrutiny.

Critical to these workflows are safeguards preventing self-approval, a basic segregation of duties that regulators from the FDIC to ISACA have long emphasized. Even senior executives should not approve their own expenses, regardless of the amount. The best platforms enforce this automatically, routing expenses to appropriate alternate approvers when conflicts arise. This protection extends to situations where an employee might indirectly approve their own expense through a subordinate who typically reports to them.

The practical impact transforms daily operations. Finance teams spend significantly less time on manual reviews when preventive controls catch violations upfront. Employees benefit from immediate clarity about whether a purchase complies with policy, eliminating uncertainty about reimbursement approval. The reduction in back-and-forth communications about expense approvals alone justifies the investment in automated workflows for many organizations.

Automated receipt capture

Expense platforms have largely solved the receipt problem that plagued finance departments for decades. Instead of chasing employees for crumpled receipts weeks after purchases, software captures documentation automatically through multiple channels. The best platforms auto-generate itemized receipts using card network data when available, eliminating manual entry for many transactions.

Employees can submit receipts through mobile apps, email, or even Slack, with optical character recognition technology automatically matching receipts to corresponding transactions. This approach aligns with IRS Publication 463 requirements for expense documentation while dramatically reducing administrative burden. The software reads the receipt, extracts vendor information, date, and amount, then matches it to the appropriate card transaction without human intervention.

The shift from manual to automated receipt management addresses one of the biggest compliance risks in expense reporting. Lost receipts no longer mean non-deductible expenses or audit findings. Searchable digital storage means finance teams can retrieve any receipt within seconds, rather than digging through filing cabinets or email archives. This capability becomes particularly valuable during tax season or regulatory audits when documentation requests can span multiple years.

Real‑time card controls and virtual cards

Virtual cards fundamentally change how companies manage vendor relationships and recurring payments. Instead of sharing a single corporate card number across multiple vendors, companies issue unique virtual corporate cards for each merchant relationship. A LinkedIn-specific card handles advertising spend, while a separate FedEx-locked card manages shipping expenses. This approach creates automatic categorization and eliminates the confusion of shared card numbers across departments.

Real-time controls on these cards provide immediate policy enforcement at the point of purchase. Finance teams can block entire merchant categories using MCC codes, preventing entertainment expenses during budget freezes or restricting travel bookings to approved vendors. Spending limits adjust dynamically based on project budgets or seasonal needs. When an employee attempts a purchase that violates policy, the transaction declines instantly rather than creating a compliance issue weeks later.

The security benefits extend far past basic spend controls. When a vendor experiences a data breach, companies can cancel and reissue only that specific virtual card without disrupting other payment relationships. Employee departures no longer require replacing physical cards or worrying about saved payment information on vendor websites. Access to virtual cards terminates immediately upon separation, while physical card collection often takes days or weeks.

This granular control also simplifies vendor management and budget tracking. Each virtual card can have its own spending limit, expiration date, and approval requirements tailored to the specific vendor relationship. Subscription management becomes straightforward when each service has a dedicated card that can be paused or canceled independently. Finance teams gain visibility into exact vendor spending without parsing through mixed transaction lists or waiting for month-end reconciliation.

ERP‑ready accounting integrations

Native integrations with accounting software have become essential for expense management platforms. Companies should expect direct connections to NetSuite and QuickBooks, complete with mapping tools for categories, classes, and projects. CSV exports alone no longer suffice for organizations processing hundreds or thousands of monthly transactions. The difference between native integration and manual exports becomes clear during month-end close when properly integrated expenses flow directly into the general ledger with appropriate coding, receipts attached, and audit trails intact.

Finance teams using native integrations avoid the error-prone process of downloading, formatting, and uploading spreadsheets between platforms. Transactions sync automatically with the correct general ledger codes, cost centers, and project allocations. The time savings compound each month, freeing accounting staff to focus on analysis rather than data entry. Most importantly, native integrations reduce the risk of errors that come from manual data manipulation and rekeying information across platforms.

Global reimbursements

International operations require expense platforms that handle multiple currencies and local payment methods effectively. Employees should receive reimbursements in their local currency, eliminating foreign exchange confusion and reducing processing delays. A London-based employee receives pounds, while their Tokyo colleague gets yen, all processed through the same platform. This localized approach speeds up reimbursement times and reduces questions about exchange rates or conversion fees.

Country-specific requirements add another layer of complexity that platforms must address. Mileage rates vary significantly by country and often change annually based on government guidelines. US companies should reference IRS-published standard mileage rates, while international subsidiaries need rates from their local tax authorities. Platforms that automatically update these rates ensure compliance without manual maintenance, reducing the risk of over or under-reimbursing employees for travel expenses.

Built‑in travel and expense management (T&E)

A complete expense platform should integrate travel booking directly into the expense management workflow. When employees book flights, hotels, and rental cars within the same platform where they submit expense reports, travel policies apply consistently at the point of booking. This eliminates the disconnect between travel procurement and expense reporting that often leads to policy violations and budget overruns.

Access to broad inventory matters as much as policy enforcement. Platforms powered by global distribution networks provide extensive travel options while maintaining negotiated corporate rates and preferred vendor agreements. Employees get the convenience of consumer booking sites with the control and pricing advantages of corporate travel management.

The reality of business travel extends well past the initial booking. Delayed flights in Singapore and canceled hotel reservations in London require immediate assistance, not callbacks during US business hours. The best platforms provide 24/7 agent support through multiple channels, helping employees rebook travel, handle emergencies, and resolve payment issues. This support encompasses both booking assistance and expense resolution, ensuring travelers never feel stranded.

Perhaps most valuable is the data insight that emerges from travel and expense management. Finance teams can track spending from initial booking through final expense submission, spotting patterns like frequent booking changes or consistently exceeded per diem rates. These insights drive better vendor negotiations, more accurate budget forecasting, and targeted policy adjustments based on actual travel behavior rather than assumptions about how employees book and spend.

AP/Bill pay automation

The convergence of expense management and accounts payable creates significant efficiency gains for finance departments. Leading platforms now handle the full invoice workflow, from email ingestion and optical character recognition to purchase order matching and payment execution. Vendors can submit invoices directly through email, where AI extracts key data fields and matches them against existing purchase orders. The platform then routes invoices through appropriate approval chains based on amount, vendor, or expense category.

Payment execution happens within the same platform, supporting ACH transfers, wire payments, checks, and even virtual card payments. This consolidation means finance teams manage corporate cards, employee reimbursements, and vendor invoices through a single interface. This approach improves cash flow visibility, simplifies month-end reconciliation, and provides better control over all outgoing payments. Rather than logging into multiple banking portals and payment platforms, treasury teams can schedule and track all payments from one location.

Vendor onboarding and management also benefit from automation within integrated platforms. Vendors can self-onboard through secure portals, providing tax documentation, banking details, and insurance certificates without manual back-and-forth. The platform maintains a centralized vendor database that syncs with the ERP, ensuring consistent vendor records across all financial processes. This automation reduces the risk of payment fraud, ensures tax compliance, and accelerates the vendor setup process from weeks to days.

Analytics and compliance reporting

Compliance monitoring requires platforms that surface spending anomalies through dynamic dashboards and guided review workflows. Finance teams need visibility into duplicate submissions, split transactions designed to avoid thresholds, and unusual patterns that might indicate fraud. The best platforms automatically flag these exceptions with context, letting teams focus on outliers while routine expenses flow through. Continuous tracking of metrics like receipt attachment rates and submission delays helps identify problems before they become audit findings.

Export capabilities must support both operational and regulatory requirements with detailed audit trails. Tax authorities and auditors expect electronic documentation showing when expenses were incurred, submitted, approved, and paid. Platforms should export this information in standard formats with all supporting documentation attached. The ability to produce complete records on demand reduces audit preparation time and ensures compliance with varying regulatory standards across jurisdictions.

Security, SSO, and provisioning

Enterprise expense platforms must meet rigorous security standards to protect financial data and maintain compliance. SOC 2 Type II attestation provides independent verification that a platform maintains appropriate controls for security, availability, and confidentiality. PCI-DSS compliance ensures credit card data receives proper protection throughout processing and storage. Companies should request and review these audit reports before implementation, as they reveal the platform's actual security practices rather than marketing claims.

Single sign-on integration streamlines access management while improving security. Platforms should support major identity providers like Okta and Microsoft Entra ID (formerly Azure Active Directory), allowing employees to access expense tools with existing corporate credentials. SCIM provisioning automates user creation and deactivation, ensuring terminated employees lose access immediately. This automation becomes particularly important for organizations with high turnover or seasonal workforce changes, where manual access management creates unacceptable security gaps.

Multi‑entity and multi‑currency support (incl. VAT)

Organizations operating across multiple legal entities need platforms that maintain separation while enabling consolidated reporting. Each entity requires its own funding sources, approval chains, and accounting codes, yet finance teams need unified visibility across all operations. The platform should allow different expense policies by entity, recognizing that acceptable expenses in one country might violate regulations in another. VAT tracking and recovery add another layer of complexity, particularly for European operations where VAT rates and reclaim rules vary by country and expense type.

Currency management involves more than simple conversion calculations. Platforms must handle reimbursements in local currencies, maintain exchange rates for reporting purposes, and manage the timing differences between when expenses occur and when they're reimbursed. Multi-currency policies should reflect reality. A client dinner in Tokyo costs more than one in Manila, and platforms need different thresholds by location. The best solutions automatically update exchange rates daily and maintain historical rates for accurate period reporting.

Mobile and collaboration workflows

Mobile applications have shifted from convenience features to essential tools for expense compliance. Employees can photograph receipts immediately after purchases, eliminating lost documentation. They can submit expenses while traveling, complete memos with transaction details fresh in memory, and approve team expenses without returning to their desks. The mobile experience should match desktop functionality, not offer a stripped-down subset that forces users to wait for computer access.

Integration with collaboration tools like Slack transforms expense management from a separate task to part of natural workflow. Managers approve expenses through Slack notifications without leaving ongoing conversations. Employees add receipts and memos directly in team channels where purchases were discussed. These integrations reduce the friction that leads to delayed submissions and missing documentation. When expense management fits into existing communication patterns, compliance improves without additional training or enforcement efforts.

The 5 best expense management software solutions of February 2026

Here are the best expense management tools to help control your company’s spending and automate your financial processes.

1. Brex

Brex is the leading expense management software because of its integrated approach, which combines cards, expenses, reimbursement, bill pay, travel, and business banking on a single platform. With customizable spend controls, thousands of software integrations, and AI-powered accounting automation, Brex ensures businesses of all sizes and stages can manage their expenses effectively.

It starts with the Brex card seamlessly integrated into our expense management platform. You can provision spend limits and auto-enforce your policy at the time of purchase. This prevents out-of-policy spend or rogue transactions before they happen and helps employees use their credit card with confidence. You also get full visibility into your overall transactions, whether made by card, ACH, wire, or business bank account.

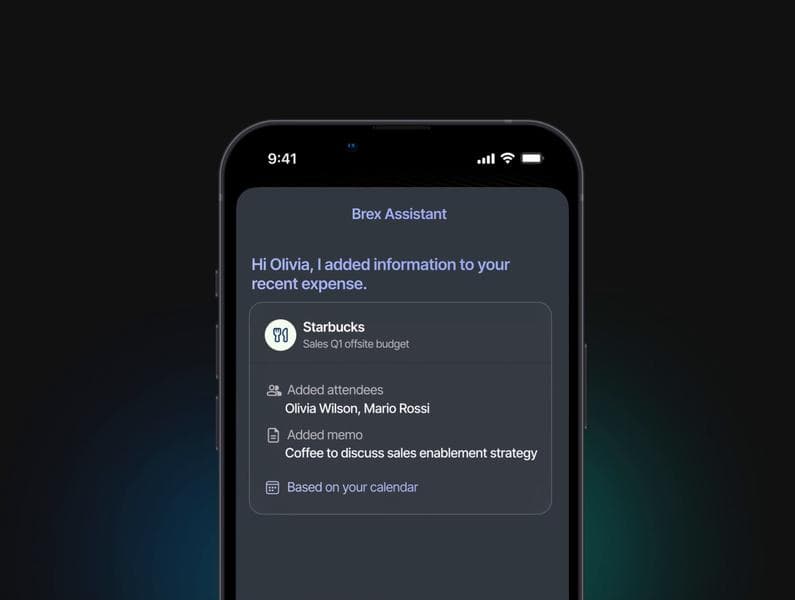

Brex also automates document collection on expenses for you by automatically generating receipts for thousands of merchants. Brex Assistant even helps employees get answers to common expense questions and complete tasks in real time, so they don’t have to bog down finance to complete the expense process.

Further, Brex’s expense platform provides AI-generated suggestions for accounting teams as well as AI-generated mapping rules to enable accounting automation. This removes much of the manual work for expense reconciliation, eliminating errors and saving countless hours so you can close the books faster.

Key features

- Automatic receipt capture: Brex auto-generates receipts for many merchants and simplifies receipt scanning for others, so missing receipts are virtually a non-issue.

- AI-powered expense categorization: The platform uses AI to categorize expenses and fill in details (like memos or attendee names) using transaction data, saving employees and accountants time.

- Automated approvals and reviews: You can configure policies so that routine expenses within certain limits get auto-approved, while out-of-policy expenses are flagged for review, streamlining the approval workflow.

- Customizable, auto-enforced spending policies: Brex lets you set rules (by amount, category, vendor, etc.) and will automatically enforce them at the point of sale with the Brex card. This prevents violations upfront.

- Integrated corporate card with high limits: Brex provides a corporate card (with 20x higher limits for qualified startups) that ties directly into the software. Card spending is tracked in real time with no need for separate reconciliation.

- Real-time spend tracking and ERP integrations: Transactions appear instantly in Brex, and the system can sync with tools like NetSuite, QuickBooks, Xero, or Sage Intacct for smooth month-end closing.

- Global bill pay capabilities: Outside of travel and T&E expenses, Brex can also handle vendor payments, with support for multiple payment methods and currencies, useful for managing all company spend in one place.

- Real-time reporting and analytics: Brex offers dashboards and reports that update live, giving insights into spend by department, category, and more.

- Integrated business account: Optionally, Brex provides a business banking account with an industry-leading yield on deposits, so companies can manage cash and expenses together.

- Multi-currency and multi-entity support: Brex supports expenses in many currencies and can handle global subsidiaries, helping international businesses stay compliant and manage expenses across borders.

Key benefits

- Holistic expense management automation: Because Brex combines cards, expenses, bill pay, and travel, you get end-to-end automation. This reduces manual work at every stage, from swipe to reconciliation, and ensures nothing falls through the cracks.

- Increased productivity for employees and finance teams: Employees spend less time fussing with expense reports, and finance can trust the automated system to handle coding and compliance. This frees everyone to focus on more strategic work.

- Better compliance and lower risk: Brex's real-time controls and policy enforcement mean employees are guided to spend within policy, dramatically reducing out-of-policy expenses. Greater compliance reduces the chance of mistakes or fraud. (Brex's automation has been shown to help companies achieve up to 99% policy compliance.)

- Faster reimbursements and month-end close: Automation speeds up the entire process. Employees get reimbursed faster for any out-of-pocket spends, and the finance team can close the books much quicker when most expenses are pre-coded and verified.

- Up-to-the-minute visibility: With live data on all transactions, managers have full transparency. They can see budgets vs. actuals at any time, which improves budget management and financial decision-making in real time.

Drawbacks

- Must use Brex cards to unlock the full benefits

- Small mom and pop businesses may not qualify for the Brex card

- Travel product more suited for early-stage and growth companies

Pricing

Brex offers flexible pricing for companies at every stage. Brex Essentials is free for startups and growing organizations. Brex Premium is great for midsized companies that need custom expense policies, approvals, and integrations and starts at $12 per user/month. For larger enterprises with more complex needs, Brex Enterprise includes enhanced global capabilities and custom services; pricing is tailored to the customer. In all cases, the Brex card has no annual fee, and you earn rewards on card spend.

Overall

High-growth businesses, from ambitious startups to established enterprises will benefit from brex’s comprehensive spend management software solutions. Brex's advanced spend controls and automation features will help organizations with lots of transactions automate the expense and accounting processing. Those organizations with global operations or multi-entity structures will benefit from Brex’s multi-currency support. However, smaller businesses with limited expenses may find less value in Brex’s full suite of services.

2. Zoho Expense

Zoho Expense is a popular travel and expense management solution for growing businesses. It will help you organize the expense management process, from receipts to reimbursement. With expense report automation, Zoho Expense will add expenses to a report and submit it for you.

Key features

- Expense report automation

- Corporate card reconciliation

- Third-party integrations

- Automated and custom approvals

- Extensive customization options

Key benefits

- Comprehensive expense management platform for small businesses

- Increased employee and business efficiency

- Advanced customization and flexibility

Drawbacks

- Limited support for global expenses

- Integration challenges with other business applications

- A bit of a learning curve to get started

Pricing

Zoho Expense is free for small businesses and freelancers. Growing businesses can access Standard licensing for $4/month and Premium licensing for $7/month, which includes more global capabilities. Zoho offers custom pricing for large-scale enterprises.

Overall

Zoho Expense is particularly well-suited for small and midsize businesses looking to streamline their expense management processes. Its automated expense reporting, card reconciliation, and customizable approval flows, makes it an excellent choice for small businesses and freelancers seeking to enhance efficiency and reduce manual work. However, enterprises with complex global operations or those requiring seamless integration with a wide range of business applications may find more value in solutions like Brex.

3. Expensify

Expensify is one of the best-known names in expense management for small businesses. It's a versatile solution designed for freelancers, solopreneurs, and small companies seeking their first expense management tool. Expensify gained popularity by making it extremely easy for employees to capture receipts and submit expenses via smartphone, operating under the mantra "Receipts that don't suck!"

Key features

- Unlimited receipt tracking

- Native integrations

- Invoicing and bill paying solutions

- In-app travel booking

- Mileage tracking

Key benefits

- Save time and improve productivity with automation

- Manage expenses, book travel, and pay bills in one place

- Can import transactions from external card programs

Drawbacks

- Slower domestic and global reimbursements

- Limited capabilities for multi-currency expenses

- Expect upcharges for premium functionality

Pricing

Pricing for Expensify seems pretty straightforward, though there is no free tier for businesses (only individuals). The Collect license is best for 1 to 10 employees and costs $5 user/month. The Control tier can serve anywhere from 10-1,000 employees and costs $9 user/month.

Overall

Expensify’s user-friendly interface and feature set appeal to small companies seeking to simplify their expense management processes. However, any company with international operations or those requiring rapid reimbursements might need to look elsewhere. While Expensify's tiered pricing structure allows for scalability, businesses should carefully consider their needs to ensure they're not overpaying for premium features they may not need. Modern, global businesses will likely benefit from more comprehensive expense capabilities from Expensify alternatives like Brex.

4. Coupa

(Image Source)

Coupa offers a cloud-based spend management platform that helps businesses improve their procurement, expenses, and financial processes. It offers a range of applications that help you improve spending processes, visibility, and compliance.

Features include invoicing, payments, expense management, and travel management solutions. Coupa also features an AI-driven platform that helps you extract insights from spend data, simplify workflows, and facilitate collaboration.

Key features

- 150 global ERP integrations, including Oracle, Sage, Microsoft, SAP, and Workday

- Travel and expense management

- Supply chain collaboration

- Procure-to-pay software

- AI-driven insights

Key benefits

- Industry-leading procurement solution

- Cost management and process efficiency

- Scalable for global organizations

Drawbacks

- Fewer expense management capabilities than most competitors

- Difficult integration with NetSuite

- No integrated corporate card

Pricing

To get pricing, contact Coupa’s sales for a demo and personalized quote for your business needs.

Overall

Coupa's platform is more well-suited for medium to large enterprises with complex procurement and financial processes. Organizations looking to optimize their entire spend management lifecycle, from procurement to payment, will find significant value in Coupa's comprehensive suite of tools. However, businesses specifically looking for a robust expense management solution might find Coupa's broad scope and potential complexity excessive. Additionally, firms that rely on NetSuite might benefit from using Brex due to its award-winning NetSuite integration.

5. Concur Expense

SAP Concur is an expense management and travel solution that helps companies of all sizes manage their expense, travel, and invoice processes. It integrates various aspects of travel and expense management into a single platform, increasing visibility, compliance, and control over business spending.

Key features

- Mobile accessibility and convenience

- Policy compliance and enforcement

- Easy-to-use expense management

- Integration with corporate systems

- Advanced reporting and analytics

Key benefits

- Save time and data entry through email receipt collection

- Accelerated expense and invoice policies with templates

- Enhanced accuracy through business software integrations

Drawbacks

- Outdated interface makes it difficult to use

- Manual receipt matching and expense reconciliation

- No integrated card offering, so transaction data is delayed

- Reimbursements take weeks through payroll

Pricing

To get pricing, contact Concur’s sales for a custom quote.

Overall

SAP Concur can benefit medium to large enterprises seeking a comprehensive travel and expense management tool. Its integration with SAP's broader ERP ecosystem makes it valuable for organizations already using SAP software. However, today’s tech-forward businesses might find Concur's complexity challenging and its interface outdated. Additionally, companies needing real-time transaction data or rapid reimbursements may need to consider Concur's limitations in these areas. Concur alternatives like Brex offer elevated automation capabilities via a more modern UI.

Six steps to follow in your expense management workflow

Implementing an expense management software will typically transform your workflow into a much smoother sequence. Here are six simple steps in a modern expense management process, and how today’s software makes each step easier:

Step 1: Employees input expenses and receipts

Employees use a mobile app or desktop interface to record expenses as they occur. Instead of saving up a stack of receipts, they can log each expense on the fly, for example, by snapping a photo of a receipt or forwarding an email receipt to the system. Modern tools use OCR to auto-fill details, but employees may add any necessary info (like a project code or business purpose) at the time of purchase. This immediacy means expenses are less likely to be forgotten and are recorded accurately with digital proof.

Step 2: Employees submit expenses for approval

Once employees have all their expenses recorded for a period (say a week, a month, or after a business trip), they submit them for approval. Often, the software allows bundling expenses into a report or will have already compiled a report automatically. With one click, the report goes to the relevant manager. The employee's job is basically done, with no printing forms or emailing spreadsheets. The software routes everything to the approver instantly.

Step 3: Managers review and approve expenses

Managers (or designated approvers) receive a notification that an expense report is awaiting review. They can see each expense, along with attached receipts and any flags from the system. Modern expense software uses built-in checks at this stage, for example, using OCR and AI to verify that receipts match the entered amounts and that expenses comply with policy. If something is off (like a receipt is missing or a policy was violated), the system flags it for the manager. The manager can then approve the report, or reject/send back any expenses that need clarification. Thanks to automation, this review is faster because the manager only needs to focus on exceptions; the compliant expenses can often be auto-approved or at least are clearly marked as OK by the system.

Step 4: The software generates an expense report

Upon approval, the software finalizes the expense report and creates an audit trail for each transaction. This means every expense is logged with details of who spent what, when, why, and who approved it. If any expenses were flagged in Step 3 and then resolved, those notes are recorded too. This report serves as a record for both internal purposes and any future audits. It's searchable and stored in the system, eliminating the need for keeping paper receipts in a file cabinet. If your finance team or an external auditor ever needs to review expenses, everything is documented and easily accessible.

Step 5: Those expenses sync with your existing tech stack

Once approved, the expenses don't live only in the expense software; they sync with your accounting/ERP system for financial reporting. Modern expense tools integrate with systems like QuickBooks, Oracle NetSuite, SAP, etc., so that each expense (with its proper category, amount, and any project or client tags) flows into your general ledger. This step is crucial for accurate bookkeeping and timely financial close. Instead of accountants manually re-entering data from reports into the ledger, the integration posts those transactions automatically to the right accounts. This means by the time you're closing the month or quarter, all those hundreds or thousands of expense transactions are already in your financial system, greatly speeding up the closing process.

Step 6: Employees get reimbursed for out-of-pocket expenses

Not all expenses may go on a company card. Sometimes employees pay out-of-pocket (cash or personal card) for something and need to be paid back. In those cases, after approval, the expense management system will trigger a reimbursement. Many platforms can handle employee reimbursements directly, either by initiating an ACH transfer to the employee's bank account or by feeding the info to your payroll system for inclusion in the next paycheck. If your company provides a corporate card for most expenses, this step might be rare, but it's there for things like mileage, tips, or vendors that couldn't be put on a card. The best expense management software can reimburse employees in just a few days (some even next-day), which is much faster than older manual methods. If a company uses corporate cards exclusively, this step is effectively skipped. Employees don't front their own money, which is even better for them.

Just six simple steps in an expense management solution can reduce errors and save time. Plus, it’s more accurate than the manual approach using spreadsheets and physical expense reports, which are time-consuming and prone to mistakes.

Top 5 benefits of automated expense management

These automation-specific advantages build on the broader benefits of expense management software that apply to any solution you choose. In a recent Brex survey, 32% of companies cited slow reimbursements and time-consuming approvals as the main challenges with T&E programs. Thirty-one percent struggled with integrating software, like accounting systems. And 29% had issues with employees not submitting expense documentation.

Here’s how automated expense management can change that.

Improved integrations

Automated expense management software integrates directly with accounting, HR, and other enterprise systems to eliminate manual data entry. When expense data flows automatically into accounting platforms like QuickBooks, finance teams can close their books faster without re-keying transactions. The software also syncs with HR systems to automatically provision new employees with appropriate spending permissions and deactivate accounts when staff members depart. This integration architecture reduces errors inherent in manual processes while ensuring data consistency across all business systems.

Better compliance

Automated expense software embeds corporate spending policies directly into the transaction flow, automatically rejecting purchases that exceed preset limits or lack required documentation such as client names for business meals. Rather than relying on employees to remember rules or managers to catch violations after the fact, the software enforces compliance at the point of purchase and requires digital receipts for every transaction.

Achieve up to 99%* compliance and save your team up to 4,000 hours a year with expense automation. Try Brex now.

*The metrics provided are from July 2023 and are for illustrative purposes only. Past performance does not guarantee future results, which may vary.

Increased efficiency

- Perhaps the most obvious benefit, but worth emphasizing, automation makes the entire expense reporting and reimbursement process far more efficient. Some specific ways it speeds things up include the following.

- Fewer errors occur when the system is reading receipts and matching items, resulting in fewer typos or mistaken entries. Eliminating errors means less time fixing mistakes or back-and-forth with employees to clarify things (remember, it costs an average of $52 to correct an expense report error, according to industry studies, once you factor the time and labor involved). Fewer errors eliminate those costly delays.

- Faster submissions happen because it's quicker for employees to snap a receipt and have an expense auto-created than to fill out a spreadsheet. So they submit expenses more promptly, and you don't have to nag them as much. That means finance can start processing expenses sooner, and nothing piles up.

- Quicker approvals are possible since managers can review expenses in a few clicks, often on their phone. Automated alerts and reminders nudge managers to approve, avoiding bottlenecks. Some systems even auto-approve trivial amounts. All this frees managers from spending hours on expense reports and lets them focus on their core work.

- Streamlined reimbursements mean that with direct deposit or integration to payroll, once something is approved, it's in the pipeline to be paid without additional steps. Employees get their money back faster, which keeps them happy and reduces follow-up emails asking "Where's my reimbursement?".

In short, efficiency gains mean employees get back to their real jobs faster and finance teams can handle a higher volume of expenses without additional headcount. It's a win-win for productivity.

Ensure agile expense processes

Business needs change through hiring surges, acquisitions, or new expense categories like home office stipends. Automated expense software adapts to these shifts through configurable workflows and scalable infrastructure that accommodate new users, policies, and organizational structures without requiring software replacements. Companies can merge employee populations under unified platforms while maintaining separate policies, or update compliance rules in response to new tax regulations. This flexibility ensures the expense management process evolves alongside the organization rather than constraining growth or requiring costly IT overhauls.

Enhanced security

Handling expenses involves sensitive information including employee data, financial details, and customer or project information attached to transactions. Automated expense management platforms invest heavily in security measures that surpass traditional spreadsheets or paper reports, which can be lost or accessed by unauthorized personnel. These platforms employ encryption for data in transit and at rest, role-based access controls that limit visibility according to organizational hierarchy, and authentication protocols including two-factor authentication and single sign-on.

Modern expense software also prevents fraud through automated monitoring and transaction controls. Corporate cards can be restricted by vendor, amount, or category, with round-the-clock monitoring systems that flag suspicious transactions immediately. Every action taken on an expense, from submission through approval and any subsequent modifications, creates an immutable audit trail that documents who did what and when.

These security features make automated expense management substantially safer than emailing receipts or sharing Excel files. The combination of preventive controls and detailed logging provides finance leaders with both protection and transparency into spending patterns. Companies gain enhanced financial governance alongside efficiency improvements, achieving a level of control that would be difficult to replicate through manual processes.

The role of AI in expense automation

Don’t waste hours reviewing every global expense — and risk missing ones that need a closer look.

Instead, let artificial intelligence support your accounting teams.

AI can be your team’s tireless teammate. It’s as skilled as the top industry firms and instantly understands your company’s data. (You’d need an army of associates to achieve this manually.)

For instance, with AI, you can:

- Set up automated approval workflows based on spending limits and policy rules.

- Add notifications and reminders to promote timely approvals and avoid delays.

- Use an electronic system for managers to review claims digitally.

How AI-powered expense automation works

AI-powered expense automation transforms how you handle expenses.

It can analyze each reported expense, detect non-compliant claims, and automate approval workflows. It can also instantly flag issues to make sure every report meets your policy rules.

AI expense automation can also help you:

- Review and approve claims digitally, with AI sending reminders to keep things moving.

- Scan receipts, categorize expenses, and match them with transactions.

- Create automated workflows to accelerate the approval process.

Ready to see how Brex AI can help your business streamline workflows? Let’s take a look at its features.

Accelerate your expense management with Brex AI

Brex, as a leading expense management platform, has invested heavily in AI to streamline expense workflows. Brex AI is built into the platform to help finance teams and employees alike manage expenses faster and more intelligently. Here's how Brex uses AI to accelerate expense management and what features stand out:

Automate workflows for every spend

Brex AI serves as a decision-making partner that provides automation and suggestions at each step of an expense workflow. Essentially, every type of spend (whether it’s a card swipe, a reimbursement request, or a bill payment) can trigger an optimized workflow powered by AI. For instance, if an employee makes a purchase on the Brex card, Brex AI can immediately determine if that transaction fits a normal pattern and, if so, it might auto-categorize it and mark it as policy-compliant. If it’s slightly out of the ordinary, Brex AI could prompt for additional info or send it through a custom approval route. By tailoring workflows to each spend type, Brex AI reduces manual tasks. You don’t have to set up rigid one-size-fits-all rules; the AI adapts the process depending on what’s being bought, how much, by whom, etc., all in real time.

Give every employee their own assistant

In many companies, only executives have personal assistants, but with Brex AI, every employee essentially gets a virtual assistant. The Brex Assistant allows team members to ask questions and get instant answers about their spending or company policies. For example, an employee can type or speak a question like, "How much can I spend on dinner with a client tonight?" and receive a precise answer referencing the company's T&E policy and that employee's budget limits (e.g., "You have $230 left to spend for a team dinner; note that alcohol isn't allowed on the budget"). This conversational interface eliminates the need for employees to dig through policy documents or email finance for routine questions.

The assistant also handles task execution directly. Employees can issue commands like "Submit an expense for my Uber ride yesterday," and the system creates the expense entry with the relevant details, requiring only final confirmation. This AI functionality makes the expense process nearly hands-free for end users while maintaining proactive compliance with company policies. The combination of instant guidance and automated task completion transforms expense management from a burden into a seamless part of the workday.

Put expense reports on autopilot

One of the most tedious aspects of expense management, filling out reports, is drastically reduced with Brex AI. The system auto-generates expense reports by leveraging Level 3 transaction data from card networks and its calendar integrations. Using large language models similar to ChatGPT, it automatically fills in memos, attendee names, and expense categories based on context. For example, a transaction at "Joe's Steakhouse" paired with a calendar event for a client dinner that evening would generate the memo "Dinner with client X, 4 people" and categorize it as "Client Entertainment" without human input.

By the time employees review their expenses, most fields are pre-filled by AI and receipts are often already attached, as Brex automatically generates receipts for certain transactions. This transforms expense reporting from manual data entry into a quick verification process. In optimal scenarios, reports essentially compile themselves, requiring only employee approval before submission. The result is a truly automated workflow that eliminates hours of administrative work.

Offload expense tasks to AI

Brex AI allows finance teams to delegate repetitive tasks to the AI assistant through simple commands. For instance, a manager can instruct Brex Assistant to "assign all yesterday's office lunch charges to the Team Lunch budget" or "add the memo 'Q4 offsite' to all expenses from last week's offsite event," and the AI executes these bulk operations in seconds. This capability extends to individual employees who can update expense entries with commands like "add Alice as an attendee to the dinner expense." The software transforms hours of manual data manipulation into instant, command-driven updates across hundreds of transactions.

Automate expense resolution

When issues arise such as policy violations or over-budget spending, Brex AI actively works to resolve them rather than simply flagging problems. The software automates approval for routine expenses within policy limits, routes exceptions to appropriate managers with context and risk assessments, and initiates conversations to gather missing documentation. For example, if an expense lacks a receipt, the AI messages the employee directly, attaches the photo once provided, and marks the issue resolved without finance team intervention. This automated exception handling prevents bottlenecks, transforming potential workflow disruptions into minor detours that resolve themselves through AI-driven coordination.

Reduce receipt reviews

Brex AI employs LLMs to scan receipts and expense data for policy violations, automatically detecting forbidden items such as alcohol charges that violate company policies. Rather than requiring finance teams to manually review every line item across thousands of receipts, the system flags only problematic expenses for human attention while catching violations that reviewers might miss, including personal purchases buried in lengthy receipts. This automated review process reduces audit time from hours to minutes without sacrificing accuracy. Companies maintain granular policy compliance while freeing their finance teams from the tedious work of line-by-line receipt examination.

Find transactions fast

Brex AI includes a natural-language search capability that functions like Google for corporate expenses. Users can query the system in plain English, asking questions like "Show me all marketing team expenses over $500 from last month without receipts," and receive instant results filtered by amounts, categories, dates, users, and policy conditions. This eliminates the need to export data to Excel for pivot table analysis or build complex reports. Finance teams can answer executive queries about specific spending categories or events in seconds rather than hours, transforming expense data from a static archive into an accessible intelligence resource.

Ready to transform your expense management? Try Brex AI today.

Case study: DoorDash

Here’s how Brex helped DoorDash automate expense management.

Company

DoorDash connects consumers with local businesses. The company serves 32 million users across 27 countries.

Challenge

DoorDash uses multiple cards and platforms to manage spending. As they grew, this became complicated. The user experience suffered, and managing global expenses was a headache. They needed one integrated solution for global corporate cards and reimbursements. Managers wanted a proactive way to track spending — and employees needed an intuitive experience.

Solution

DoorDash chose Brex for corporate cards and expense management.

Brex deployed a fully configured solution for DoorDash. We transitioned its ERP, HRIS, and SSO integrations quickly.

Impact

Brex’s global spend solution has empowered DoorDash employees with:

- Card acceptance in 100+ countries

- Reimbursements in 4 days or less

- Local and USD currency visibility

- 24/7 support

The finance and travel teams now have a single, real-time view of global spending.

DoorDash can pre-approve travel spending or stipends and enforce custom expense policies automatically.

The Brex mobile app also enhances the user experience. Employees can use their virtual cards, check spending budgets, request reimbursements, and add receipts from anywhere in the world.

According to Josh Pickles, Head of Global Strategic Sourcing and Procurement, DoorDash:

“The Brex app has been a major gain for us in both user experience and efficiency for T&E. It’s easy for employees to understand where and how to spend, driving accountability from top to bottom.”

Let expense management automation do the work for you

Expense management automation simplifies your processes and gives you control over your finances. It’s a smart move for any business looking to improve expense management.

By automating global expense management, you reduce errors, policy violations, and fraud. You also improve efficiency and transparency throughout the expense management process.

The bottom line? AI expense automation amplifies human effort — so your team can skip the fact-finding and go straight to better decision-making.

Want to see it in action? Try Brex for free now, or schedule a demo.

Expense management automation that makes your workday easier

See what Brex can do for you.

Learn how our spend platform can increase the strategic impact of your finance team and future-proof your company.

See what Brex can do for you.

Learn how our spend platform can increase the strategic impact of your finance team and future-proof your company.