How SeatGeek fuels growth while keeping costs in check.

SeatGeek is now a multifaceted, global business. Here’s how VP of Finance Teddy Collins is using budgets and empowering employees to build a scalable, sustainable financial operation.

How SeatGeek fuels growth while keeping costs in check.

SeatGeek is now a multifaceted, global business. Here’s how VP of Finance Teddy Collins is using budgets and empowering employees to build a scalable, sustainable financial operation.

The upside

A modern finance function is not about blocking spend — it’s about allocating resources strategically to maximize value.

With the right tools, the finance team can reduce overhead and empower teams across a company to manage their own budgets.

Being smart about expense management can eliminate tedious accounting tasks and deliver a better employee experience.

Get a front-row seat to SeatGeek’s winning strategy.

When companies grow, so do the complexities of their finances. That’s why Teddy Collins, vice president of corporate finance at SeatGeek, is always looking for ways to simplify, and to empower employees, at the fast-growing marketplace for sports, concerts, and theater tickets.

Over the past seven years, the New York-based company has grown beyond its American roots. It now has five international offices, and its employee base has jumped ten-fold to more than 800 people. SeatGeek now serves as a primary sales point for high-profile teams, such as the NFL’s New Orleans Saints and the Premier League’s Manchester City FC. It also markets its ticketing software to venues that host games, concerts, and other events.

Brex recently sat down with Collins to discuss his approach to SeatGeek's evolving finance needs and how the company is managing spend strategically to fuel growth. The following interview has been edited for length and clarity.

Q&A with

Teddy Collins, Vice President of Finance, SeatGeek

When you joined SeatGeek in 2015, it was mostly a brand for consumers seeking tickets. Now, the company does much more. How has this affected the company’s approach to finance?

We went from basically a ticket aggregation website to a proper two-sided marketplace, developing relationships with over 1,000 ticket brokers and also allowing fans to upload their tickets onto our platform. As the merchant of record for all transactions, we had to uplevel our financial systems, processes, and risk controls. What was really interesting, especially from a go-to-market strategy and finance transformation story, was when we went beyond being a US-based B2C marketplace. We acquired a B2B software company called TopTix in Israel that sold software in over 25 different countries. So we’re selling tickets in the US and a white label software solution across Europe.

Becoming a B2B2C company has been really fascinating as we’ve developed our finance stack and processes to support a deep understanding of our customers and enterprise clients.

“We’ve developed our finance stack and processes to support a deep understanding of our customers and enterprise clients.”

Given that there are B2B and B2C arms of the business, how do you approach spending decisions for the company?

We really try to take a first-principles approach, where everything starts with the company mission and the company's strategy. That turns into a company budget, and then cascades down to department budgets, and so on.

Twice a year, we refresh the strategy, making sure it's up to date for the current business landscape. In parallel, we think about profit and loss trends, our capital structure, and how much money we have to invest in the business. We then turn that into a more operational resource-allocation process focusing on what we're trying to do. We turn a top-down budget into a bottom-up planning exercise. ROI is the main driver there.

As a multi-faceted, growing company, how do you approach the tension between providing resources and keeping costs under control?

The purpose of finance goes beyond controlling activities — our mandate is to maximize the enterprise value of the company. So we try to keep as many finance-related processes within finance, and only burden the business when it's needed. That means leveraging systems and automation and being thoughtful about designing scalable processes to enable greater transparency for employees into their budgets and spend, and also reduce the overhead on accounting. With Brex, P&L owners have a real-time view into their budgets and can empower their teams with the ability to spend and report on their own budgets.

It all starts with lean processes, great quality financial and operational data, and taking a holistic long-term view of what our finance stack needs to look like. Over the past couple of years, when we implemented a lot of these compliance systems, it wasn't overly painful. We were really just formalizing a lot of the things that we were already working on.

As your business systems increase in number and complexity, what pain points are you aiming to solve, and how will Brex help you address them?

As a technology company, we have a lot of data. Our job is to leverage that data to improve our reporting and forecasts, ultimately leading to better business decisions.

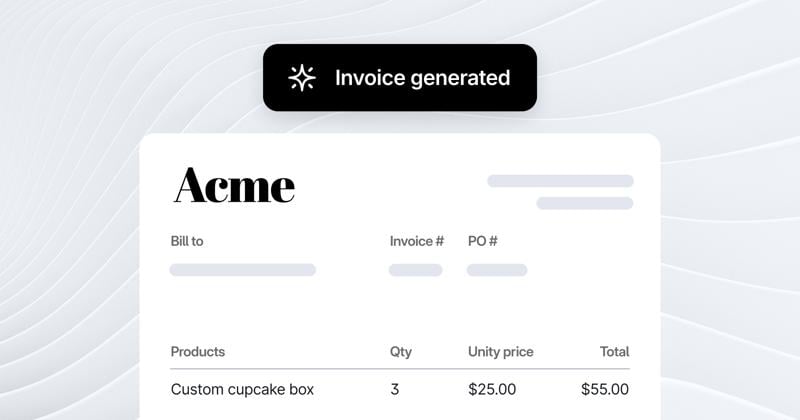

We're a cloud native company, and that means we follow a best-of-breed solutions approach to our finance and other systems. Brex Empower is a new class of product with an employee-friendly UX/UI (user experience/user interface) that allows people to see exactly how much money is left in their budget and allows them to actually spend that money, while letting us track it and do pre- and post-purchase review.

We also saw that this system can reduce our month-end close effort in a more compliant way, and also help FP&A administer the budgets in real-time a lot better, instead of weeks after the fact in the month-end close process. This the first time I'd say the FP&A group can directly empower teams to come up with and administer their own budgets. What this means is providing an end-to-end experience from conception, budget approval and empower the teams to spend with Brex. On the back end, we also have the review and approval processes to satisfy our compliance procedures. You don't want to bog employees down with filling out a purchase order request for every paperclip.

“You don't want to bog employees down with filling out a purchase order request for every paperclip.”

You’ve begun to implement Brex Empower as part of your financial operation. What is the impact you’re expecting, for finance and for employees?

We’re solving for three issues with Brex Empower. The first is that I'm confident we'll be able to reduce the accounting overhead related to expense management for credit cards by about 95%. Auto categorizing transactions makes a big difference. Currently, every transaction that comes in has to be manually coded by accounting. Now, the FP&A group can preauthorize the budget and the amount up front so there's a preventative control there.

The expense approval policy module can say if a receipt is required. Brex can auto generate receipts and associate them with expenses. That's great for accounting, and will be great for expense reports. Reimbursements will happen on a rolling basis. The process before using Brex had required the accounting team to download receipts that are submitted and manually trying to match them with expense line items in another system.

We're also super excited about the employee experience. We can tell employees what their budgets are, give them a virtual card that shows up in their Apple wallets and they can see how much is left. They can also get a physical card.

As you look ahead, how does Brex Empower feed into your long-term plans?

We're taking a multi-year view towards continuing the momentum as we compete against some pretty large competitors with significant market share. We're balancing operating the business in today's environment, but investing with the future in mind. Brex is helping us control our expenses as well as be more efficient with our #1 resource (our employees). We are looking to reduce the overhead of our credit card administration by over 50% and looking forward to coming back and sharing actual results later this year when we have the data!